Zelle

Get The App

Editor's Reviews

The Description of Zelle

Zelle is a payment app developed by several large banks in the United States to seize the market with payment services such as Venmo. With this app, bank transfers and payments have become so easy. Different from apps like Venmo, if you make an inter-bank transfer and collection through a partner bank with Zelle, it can be received within a few minutes. However, if it is not a partner institution of Zelle, Zelle will be more cumbersome to operate, and the speed of inter-bank transfer will be slower.

App Store Performance

On Google Play, Zelle's rating is 4.3, and there are 95,050 reviews so far, with a high praise rate. In addition, it has a rating of 4.8 in the IOS app market, and there are 386,015 reviews. Overall, the number of users of this app is still very high.

Zelle Pros and Cons

Pros:

1. Zelle is fee-free, users do not need to pay transfer fees

2. For many customers who use Zelle partner banks, it is very convenient to use Zelle, because many banks, such as JPMorgan Chase Bank, have fully integrated Zelle into their APP, and users do not need to download this APP separately

3. There is no transfer limit, users do not need to be limited to a certain amount when using

Cons:

1. If the user is not a customer of Zelle's partner bank, there is still some inconvenience in using Zelle, because it may take two or three days for the user to complete the transfer.

Zelle Reviews

Unlike other mobile payment apps, Zelle doesn't put money in a separate third-party account of the app itself, which is safer than a person-to-person third-party payment app like Venmo. If both parties have to check accounts with Zelle's partner banks, the inter-bank transfers can be completed in minutes. If your bank does not support Zelle, the transfer will take 1-3 days. But in any case, for each remittance initiated at Zelle, the remitter or the recipient must have an account bank that is a partner bank of Zelle. Zelle itself doesn't charge, but if your bank doesn't support the app, you'll need to check with them if there's a separate charge. Zelle currently works with more than 30 banks. A news report on Zelle said that 86 million users currently use Zelle through mobile banking, which means other banks will need to introduce the platform if they want to keep up with their competitors.

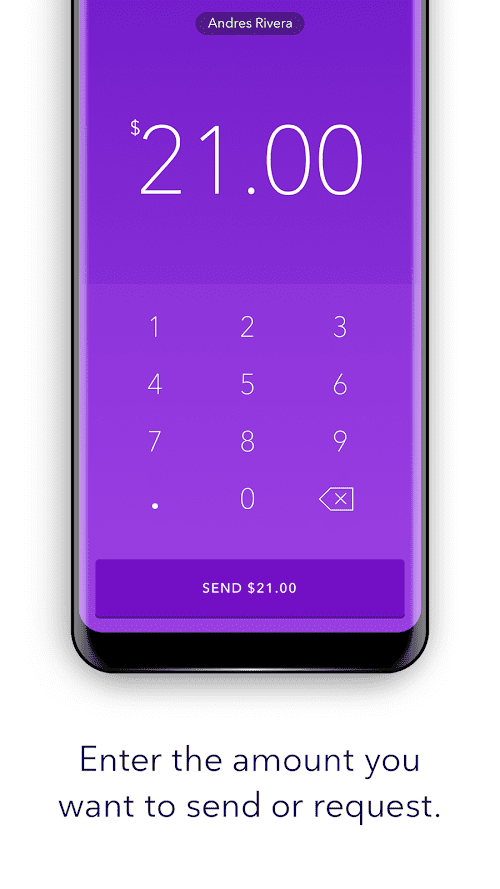

For customers of Zelle partner banks, using Zelle is very convenient. Most of these banks, like Chase, have fully integrated Zelle into their bank's app, so you don't have to download the Zelle app or create another account at all. Others, like PNC Bank, offer multiple apps through which you can access various features of Zelle. If your bank or credit institution has not yet cooperated with Zelle, you can only download the Zelle app separately from the Google Play or iTunes store, and then submit your contact information, US mobile number, email, and US Visa or Master debit The card is registered and activated. If you want to send money, you need to enter the recipient's email or phone number and the transfer amount. The recipient will receive an email or SMS notification of the remittance. If the recipient doesn't have a Zelle account, they'll receive a brief guide to help them sign up. If the recipient does not set up a Zelle account within 14 days, the transfer will expire and be returned to the sender's account. You can also use the app to initiate a payment request to the other party, provided that the other party is a Zelle user.

Zelle is free to use with no transfer fees, while other payment apps may charge a percentage of each transaction amount. While Zelle doesn't have transfer limits, your bank may have them, so it's a good idea to check with your bank or check the table below before transferring large amounts. If you're not using Zelle's partner bank, Zelle isn't the best choice. If you use a separate app to send and receive payments, it can take up to three days to arrive. In this case, Zelle is no different from other third-party apps.

Zelle does not support credit card transactions. Others, including Venmo and Square Cash, can accept credit card transactions, but require a 3% fee on the transaction amount. The last thing to note is that Zelle only works with banks in the US, not international transfers.

Editor's Reviews

The Description of Zelle

Zelle is an app published by Early Warning Services, LLC for a convenient money transfer service. It helps users wishing to send money to other people quickly. Zelle is one of the easiest ways to send money and funds arrive quickly. Also, because the app only supports bank account transfers, it has zero fees. Zelle only supports running in the user's banking app or website, so the user's funds can go directly to the recipient's account. This is very convenient and straightforward.

App Store Performance

Zelle has 95,106 reviews in Google Play store and a review of 4.3 stars out of 5. In US Apple App store it has 4.8 stars rating and ranked as #4 in Finance. There are 386.2K ratings received in iOS App store.

Zelle Pros and Cons

Pros:

1. The user's money is transferred directly to the recipient's bank account

2. It has a clean interface and simple setup

3. Has the advantage of being free and fast

4. Offers very secure transactions

5. Already working with and integrating in many banking apps

Cons:

1. Store, web or international payments are not currently supported

2. will share information with marketers

3. it has no fraud protection

4. Users cannot cancel some payments and transfers

Zelle Reviews

Zelle's foundation comes from most of the different mobile payment services. It can be said that it is part of the user's banking application or website. It doesn't go into the intermediary holding area like other money transfer services' apps, so users can pay directly to the recipient's bank account. This provides great convenience for both the user and the payee. Suffice to say, Zelle is great for users to send money with people they know easily, free, and quickly.

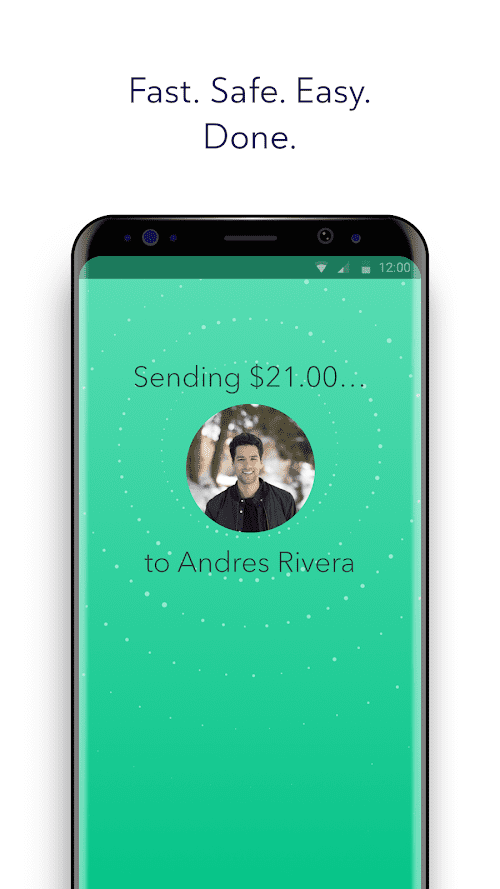

There are many advantages and features of Zelle. First of all, it is a very secure app for money transfer and payment. Zelle does not store users' personal information. This is also an important reason for its safety. Because Zelle never sees the details the user has in the bank. However, if the user transfers or pays an unknown, untrusted person, it is not feasible to return the sent remittance. Because of its instant remittance it is impossible to cancel the transaction. This is for the user's own safety. Second, Zelle's remittances are fast. It is a great tool to be able to send money quickly. In most cases, Zelle users can receive money transfers within minutes. This provides the greatest help and convenience for users' personal financial management and remittance needs. Third, users can send money without providing the recipient's bank information. Zelle users only need to provide contact information such as the recipient's phone number or email address. Zelle will automatically notify the recipient by text message or email and take care of the rest of the money transfer directly. It's all designed to save time and effort for Zelle users. Fourth, Zelle provides users with services such as integration with many banking applications, so users basically do not need to download other banking applications separately. This unification is Zelle's greatest strength. Because it has established partnerships with hundreds of banks. At the same time, users can also access Zelle directly through their bank. The most important thing is that it has no middlemen and intermediaries, so there will be no extra agency fees. Users can send their money directly to the recipient's account. Fifth, Zelle is a free application to download and use. It doesn't charge users to send or receive money, unlike most other payment apps. This is one of the reasons why many users prefer to use Zelle.

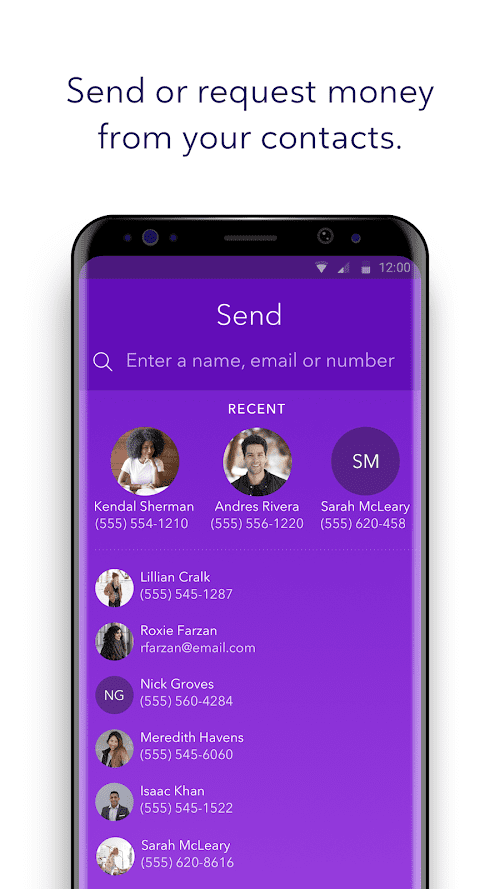

Zelle's user interface is also very simple. Its interface only comes with send, request and split options. When the user clicks send a blank contact page opens. The user can then add a new contact here by simply entering a name, phone number, email address, or a 9-digit bank routing number. So, its operation is also very simple.

Overall, Zelle is one of the easiest mobile payment apps to use and set up. Users can see that most of the bank's apps are included in Zelle functionality and there are no intermediaries and middlemen. The user's money goes directly into the recipient's bank account. It will give users a very clear and practical sense of experience. If you're looking for a friendly and great payment app, Zelle is a great one to try.