Drive Safe & Save™

Get The App

Editor's Reviews

The Description of Drive Safe & Save

Drive Safe & Save™, offered by State Farm®, is a pioneering auto insurance program designed to incentivize safe driving practices by using telematics technology to monitor and reward policyholders. This innovative approach represents a departure from the traditional factors used to calculate insurance premiums, integrating real-time driving behavior data to inform more personalized policy pricing. Participants opting into Drive Safe & Save™ have the opportunity to potentially reduce their insurance costs based on their demonstrated safe driving habits, marking a significant shift in the insurance industry.

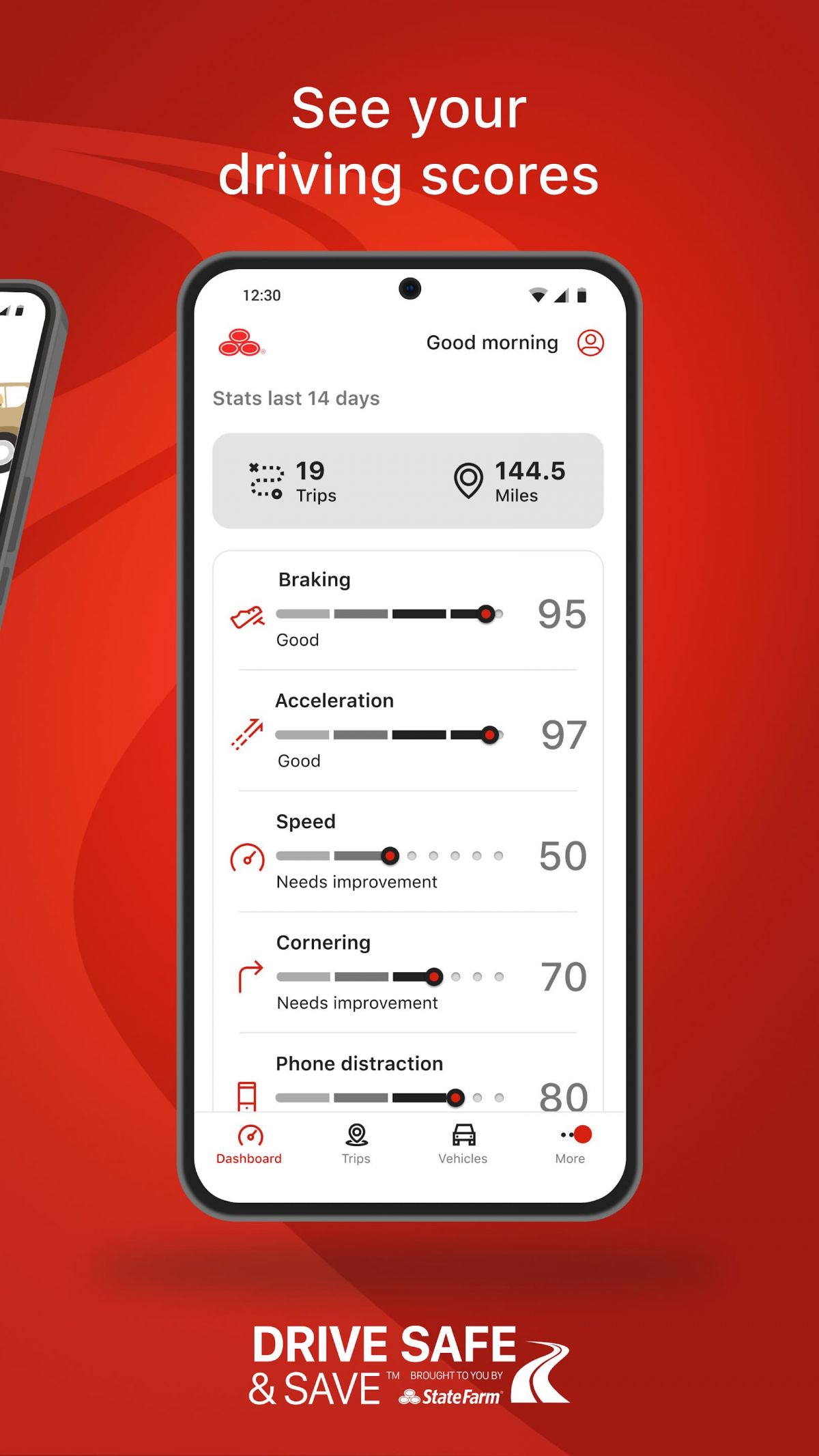

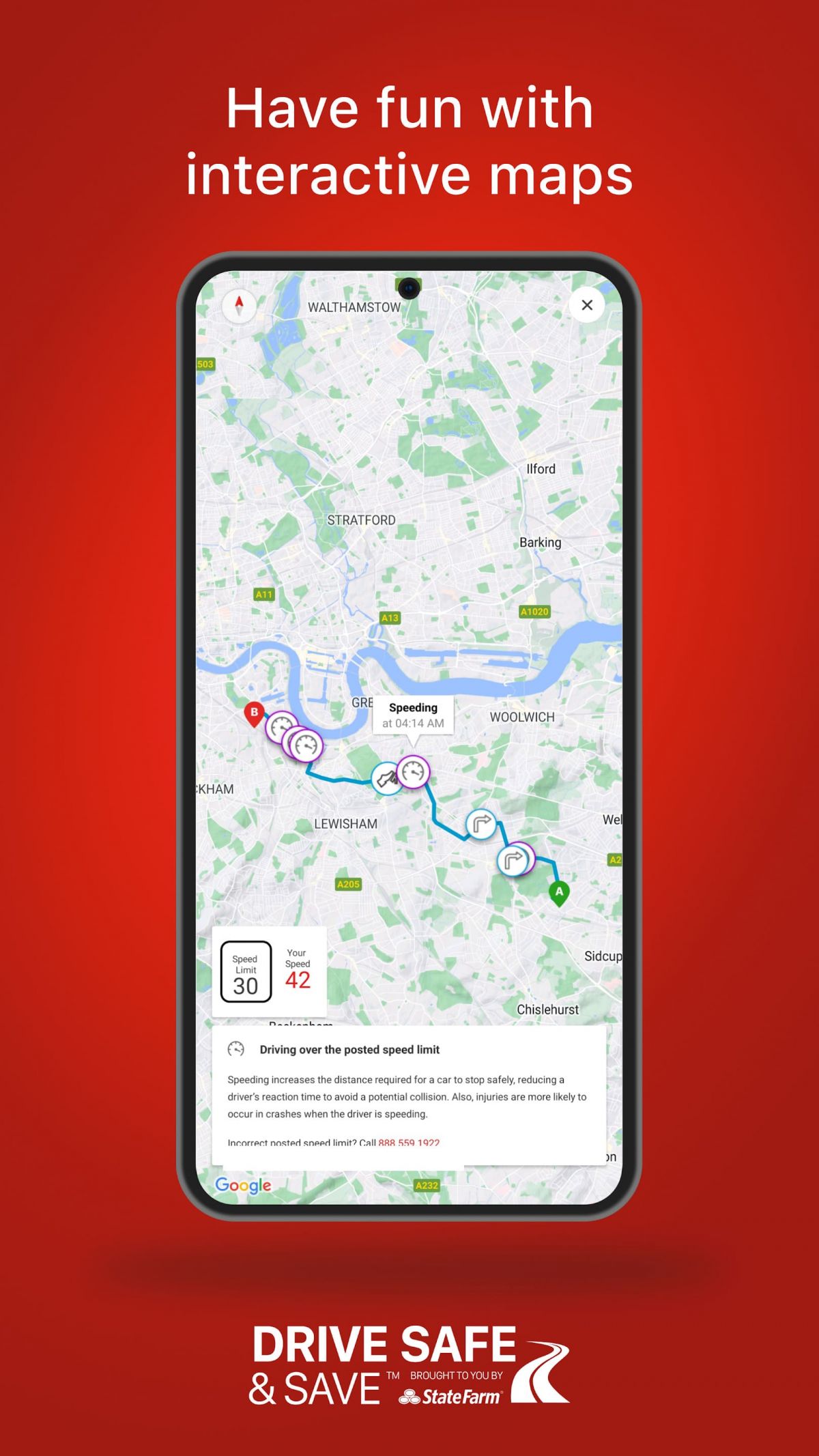

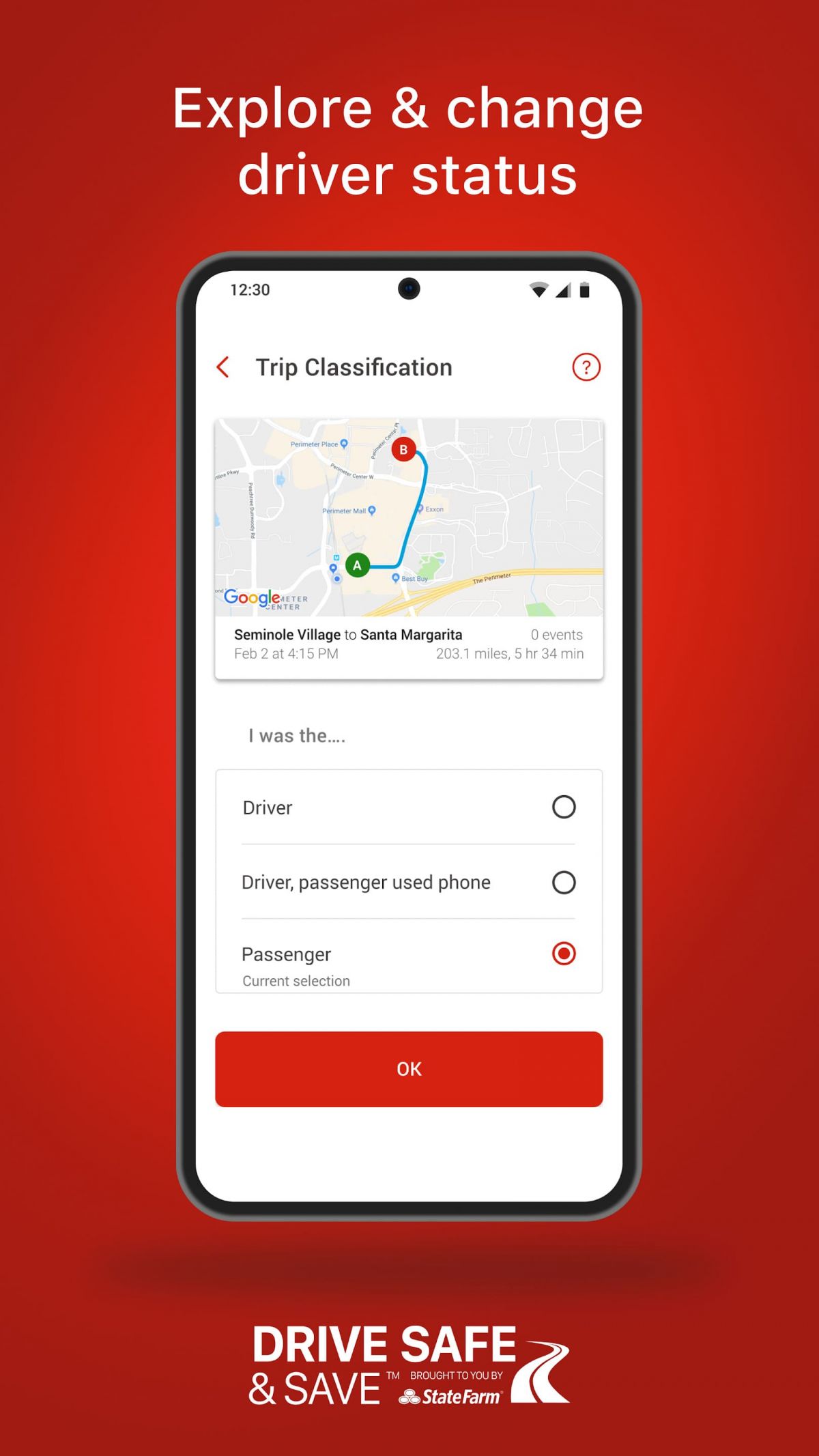

The program operates through the utilization of telematics technology, either in the form of a mobile app or in-vehicle service like OnStar®, which gathers and analyzes various driving behaviors and patterns. Factors such as miles driven, acceleration, braking, speed, and time of day when the vehicle is in use are assessed to determine the level of risk associated with the driver's habits. By actively monitoring and rewarding safe driving practices, Drive Safe & Save™ enables participants to directly influence the determination of their insurance rates, aligning their premiums more closely with their individual driving behavior.

App Store Performance

Drive Safe & Save has received 127,307 reviews on Google play with an average rating of 4 stars out of 5. On App Store, it gets an average score of 4.6 stars out of 5.

Drive Safe & Save Pros and Cons

Pros:

1. Personalized Savings: Participants have the opportunity to actively influence their insurance premiums through safe driving, potentially enjoying significant cost savings as a result.

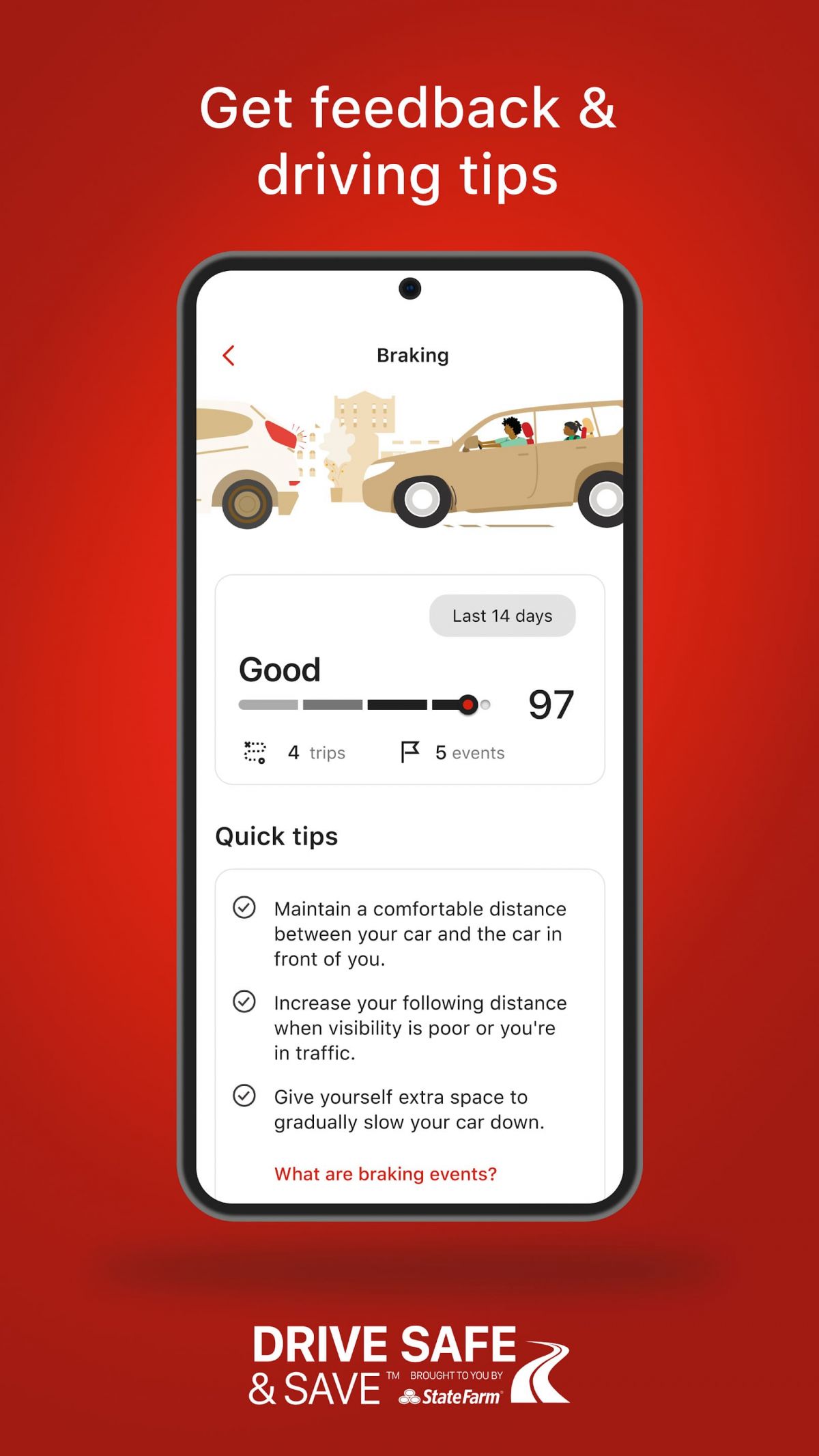

2. Feedback and Improvement: The program provides valuable insights into driving behaviors, offering users the opportunity to enhance their habits and further promote road safety.

3. Accessibility: With the use of familiar technology such as smartphones or in-vehicle systems, participation in Drive Safe & Save™ is straightforward and convenient for most drivers.

Cons:

1. Privacy Concerns: Some individuals may have reservations about the collection and potential sharing of their driving data, raising privacy considerations.

2. Limited Savings for Risky Drivers: Participants with riskier driving behaviors may not see substantial reductions in their premiums, potentially limiting the program's appeal for certain demographics.

Drive Safe & Save Reviews

One of the key features of Drive Safe & Save™ is the potential for personalized discounts based on actual driving habits. Safe drivers have the opportunity to enjoy reduced insurance premiums, providing tangible benefits for responsible behavior behind the wheel. Furthermore, the program offers valuable feedback to participants, aiding in the identification of areas for improvement in driving habits. This aspect not only creates potential for financial savings but also promotes ongoing enhancements in driving behavior and overall road safety.

Additionally, Drive Safe & Save™ ensures a user-friendly experience, with simple enrollment processes and intuitive setup for monitoring driving behavior. Participants have access to their driving data, providing transparency into the factors influencing their insurance rates and fostering trust in the program. The potential impact extends beyond individual savings, as programs like Drive Safe & Save™ have the capacity to influence wide-scale improvements in road safety by encouraging responsible driving practices across a broader segment of the driving population.

While Drive Safe & Save™ presents numerous advantages, it is not without challenges. Privacy concerns regarding data collection and sharing may be a consideration for potential participants. Additionally, drivers engaging in riskier driving behaviors may not see significant reductions in their premiums, reflecting the program's commitment to incentivizing safe driving practices.

In conclusion, Drive Safe & Save™ by State Farm® represents a progressive approach to auto insurance, utilizing advanced technology to promote and reward safe driving habits. Through its focus on personalized policy pricing and feedback mechanisms, the program not only offers tangible financial incentives for safe driving but also contributes to the larger objective of enhancing road safety. As telematics technology continues to integrate into everyday life, programs like Drive Safe & Save™ exemplify the positive impact of leveraging technology to drive and sustain safer driving habits.

Editor's Reviews

The Description of Drive Safe & Save

Drive Safe & Save™, a program offered by State Farm®, represents a paradigm shift in the auto insurance industry by incorporating telematics technology to reward safe driving behaviors. This innovative program operates through the use of mobile apps or in-vehicle telematics devices to track various driving metrics, such as mileage, speed, acceleration, and braking patterns. By leveraging this data, Drive Safe & Save™ offers personalized insurance premiums based on actual driving habits, fostering a greater alignment between individual behavior and policy costs.

App Store Performance

Drive Safe & Save has received 127,307 reviews on Google play with an average rating of 4 stars out of 5. On App Store, it gets an average score of 4.6 stars out of 5.

Drive Safe & Save Pros and Cons

Pros:

1. Transparency: Participants have access to their driving data, fostering trust and allowing them to understand how their behaviors influence their insurance rates.

2. Promotion of Safety: By rewarding safe driving practices, the program contributes to improved road safety on a broader scale, creating positive social impact.

Cons:

1. Reliance on Technology: The effectiveness of the program is dependent on the consistent and accurate functioning of telematics technology, which could pose concerns about overreliance on digital systems.

2. Data Accuracy and Interpretation: There may be instances where driving data is incorrectly captured or interpreted, potentially impacting the fairness of the program's assessment of driving habits.

3. Cost and Accessibility: Some individuals may not have access to the necessary technology required for full participation in the program, potentially excluding certain segments of the driving population from its benefits.

Drive Safe & Save Reviews

One of the primary advantages of Drive Safe & Save™ is the potential for participants to actively influence their insurance rates. Drivers who demonstrate safe and responsible behaviors behind the wheel have the opportunity to earn discounts on their premiums, reflecting a tangible financial incentive for promoting road safety. Additionally, the program offers valuable feedback on driving habits, allowing participants to identify areas for potential improvement and encouraging the adoption of safer practices.

Furthermore, Drive Safe & Save™ promotes accessibility and transparency. The use of common technologies, such as smartphones and in-vehicle systems, ensures that participation in the program is convenient for a wide range of drivers. Participants also have access to their driving data, providing insight into how their behaviors directly impact their insurance rates and fostering a sense of trust and understanding.

While Drive Safe & Save™ offers numerous benefits, it is not without its considerations. Privacy concerns related to data collection and sharing may arise among potential participants, emphasizing the need for robust data management and privacy measures. Moreover, the program's reliance on telematics technology may pose challenges, such as data accuracy and interpretation, as well as potential disparities in accessibility for drivers who do not have access to the required technology.

In conclusion, Drive Safe & Save™ by State Farm® stands as a progressive and forward-thinking program that leverages telematics technology to incentivize safe driving practices. By offering personalized insurance premiums, promoting feedback and improvement in driving behavior, and aligning policy costs with individual habits, the program sets a precedent for a more integrated and tailored approach to auto insurance. Through its emphasis on transparency, accessibility, and the potential for broader positive impacts on road safety, Drive Safe & Save™ represents a significant evolution in the insurance landscape.